Natural Capital

Collaboration Activities

Development and Investment Bank of Türkiye has invested extensively in activities to transition to a net zero economy in 2021. This included investments and efforts in energy efficiency, clean energy, infrastructure, geothermal energy projects, healthcare, and SME financing. The Bank has established global partnerships and signed several agreements that serve this purpose.

On December 10, 2019, a USD 200 million loan agreement was signed with the Asian Infrastructure Investment Bank (AIIB) to finance renewable energy and energy efficiency projects. By the end of 2021, this loan was fully utilized, and a USD 100 million Additional Financing Agreement was signed. The additional financing was fully utilized in 2022.

A “Clean Energy and Energy Infrastructure Installment Sales Loan” agreement was signed with the Islamic Development Bank to finance clean energy and energy infrastructure investments and to finance investments that will contribute to the environment. These partnerships confirm the Bank’s commitment to sustainable energy projects and its leadership in this field.

In December 2021, agreements were signed for the sale of a privately owned company’s facilities with a total installed capacity of 55 MW operating in the renewable energy sector and subject to the Renewable Energy Resources Support Mechanism (YEKDEM). Within the scope of these agreements, the transfer transactions were completed in the first quarter of 2022.

In 2022, work continued on the privatization process of selected ports and some power plants owned by The Electricity Generation Corporation (EÜAŞ), for which consultancy services provided to the Privatization Administration continued. In this context, 4 privatization tenders have been completed and work is currently underway for 4 tenders planned for 2023. In the private sector, the Bank provided merger and acquisition advisory services to companies operating in the energy, chemicals, automotive, packaging, retail and technology sectors. While work on these projects continues, the Bank successfully completed the sale of a company in the renewable energy sector in 2022.

These agreements and investments underscore Development and Investment Bank of Türkiye’s active role in supporting the transition to a net zero economy and its commitment to sustainable financing. The Bank plays an important role in managing the risks of climate change and creating a sustainable future.

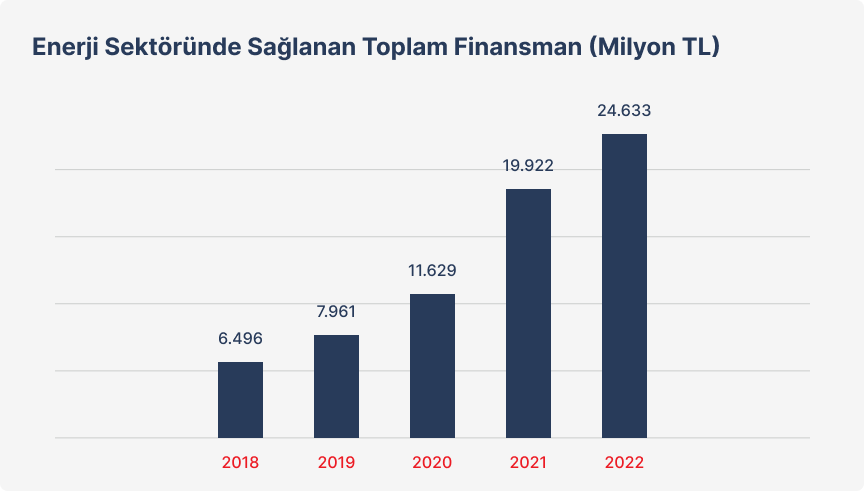

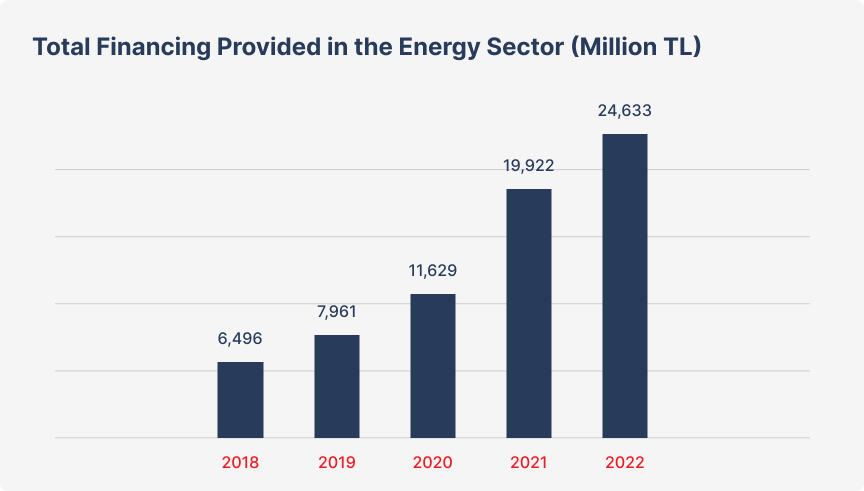

As of end-2022, 79 percent of the Bank’s portfolio consisted of

sustainability-themed loans totaling USD 2.5 billion. Financing for

renewable energy projects accounted for 41% of the loan portfolio

in 2022. The Bank financed renewable energy facilities with an

installed capacity of 3,228 MWe.

In 2022, Development and Investment Bank of Türkiye contributed to

the prevention of 4.5 million tons of CO₂ emissions through the

renewable energy projects it financed.